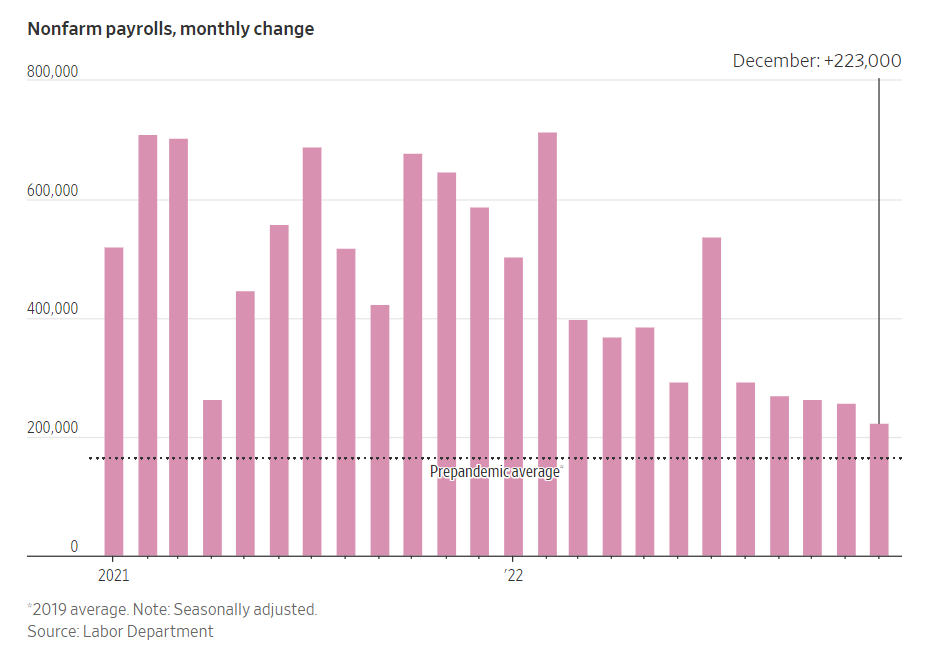

After what was shaping up to be a very disappointing start to the new year, a solid jobs report on Friday turned things around with a 700 point rally for the Dow Jones Industrial Average. The report showed employers added a very strong 223,000 jobs in December. Even though it was the slowest pace of job growth in almost two years, it was still above the pre-pandemic average. This brings the total new jobs added in 2022 to 4.5 million, the second-best year of job creation after 2021, when the labor market rebounded from Covid-19 shutdowns.

The chart below from the Labor Department, shows that 2022’s interest rate increases by the Fed are having the intended effect of slowing the U.S. economy. What buoyed investors hopes is that a fine balance of gradually slowing of the economy and inflation may be just enough to give the central bank reason to pause rate hikes in the near future. That may be just enough to forestall a more severe recession in 2023.

The Fed’s next policy meeting takes place on January 31. Stay tuned.

If you have any questions, please contact me.

The Markets and Economy

- Employers are losing patience with empty desks in the office. Companies such as Vanguard Group, Paycom Software Inc. and others have sent directives to employees in recent weeks, urging workers to follow existing rules for a balance of home work/office work schedule. Some companies are complaining that employees are taking advantage by working from home more than company guidelines state.

- More than two-thirds of the economists at 23 large financial institutions that do business directly with the Fed, believe that the S. will have a recession in 2023.

- An EU privacy regulator ruled that Facebook’s parent, Meta, violated EU privacy laws by sending unsolicited advertisements to users based on their online activity. The $414 million fine is being appealed.

- Technology-driven companies have been laying off workers at the fastest pace since the Covid-19 pandemic shocked the global economy in 2020.

- The pandemic-fueled boom in industrial real estate for warehouses appears to be retrenching in 2023. S. companies leased 28% less space in the fourth quarter compared to the third. Amazon doubled the size of its fulfillment network in the last 24 months as business surged. However, the e-commerce giant started paring back growth in warehousing operations towards the end of 2022.

- Southwest Airlines said the debacle the carrier faced over the holidays will wipe out fourth-quarter profits, costing the carrier about $825 million. The disruption has become one of the costliest the airline industry has seen in years.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, LLC, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC.